It's not you, it's Fintract

September 18, 2024 | Posted by: Chad & Patty Southwell

We often hear from clients 'why do I have to provide so much documentation'? It is usually older clients who remember a day where checks and balances were not in play. It can feel invasive ... [read more]

3 things NOT to do after your mortgage is approved

April 4, 2024 | Posted by: Chad & Patty Southwell

There are a lot of moving parts between an accepted offer and taking possession of a home. The financing component requires credit and employment checks; account statement verification; and appr ... [read more]

Financing laneway homes

March 27, 2024 | Posted by: Chad & Patty Southwell

Laneway homes have a lot of buzz between municipalities all over the country legalizing these structures and a massive housing shortage. Tiny homes, accessory dwelling units (ADU), laneway homes ... [read more]

What is a 'Level 2' mortgage agent?

March 19, 2024 | Posted by: Chad & Patty Southwell

Long story short a Level 2 mortgage agent has taken additional education and is licensed to deal and trade in mortgages provided by lenders other than financial institutions. Private lender ... [read more]

Proof of downpayment hack

February 27, 2024 | Posted by: Chad & Patty Southwell

The downpayment on a home can start as low as 5% of the purchase price. Less than 20% downpayment must be insured which is an additional cost to the borrower. Regardless of the downpayment ... [read more]

Construction draw financing

February 16, 2024 | Posted by: Chad & Patty Southwell

If you can’t find your dream home, build it! There are two kinds of construction projects. One is turnkey where the buyer does not own the home until it's complete, and secures a mortgag ... [read more]

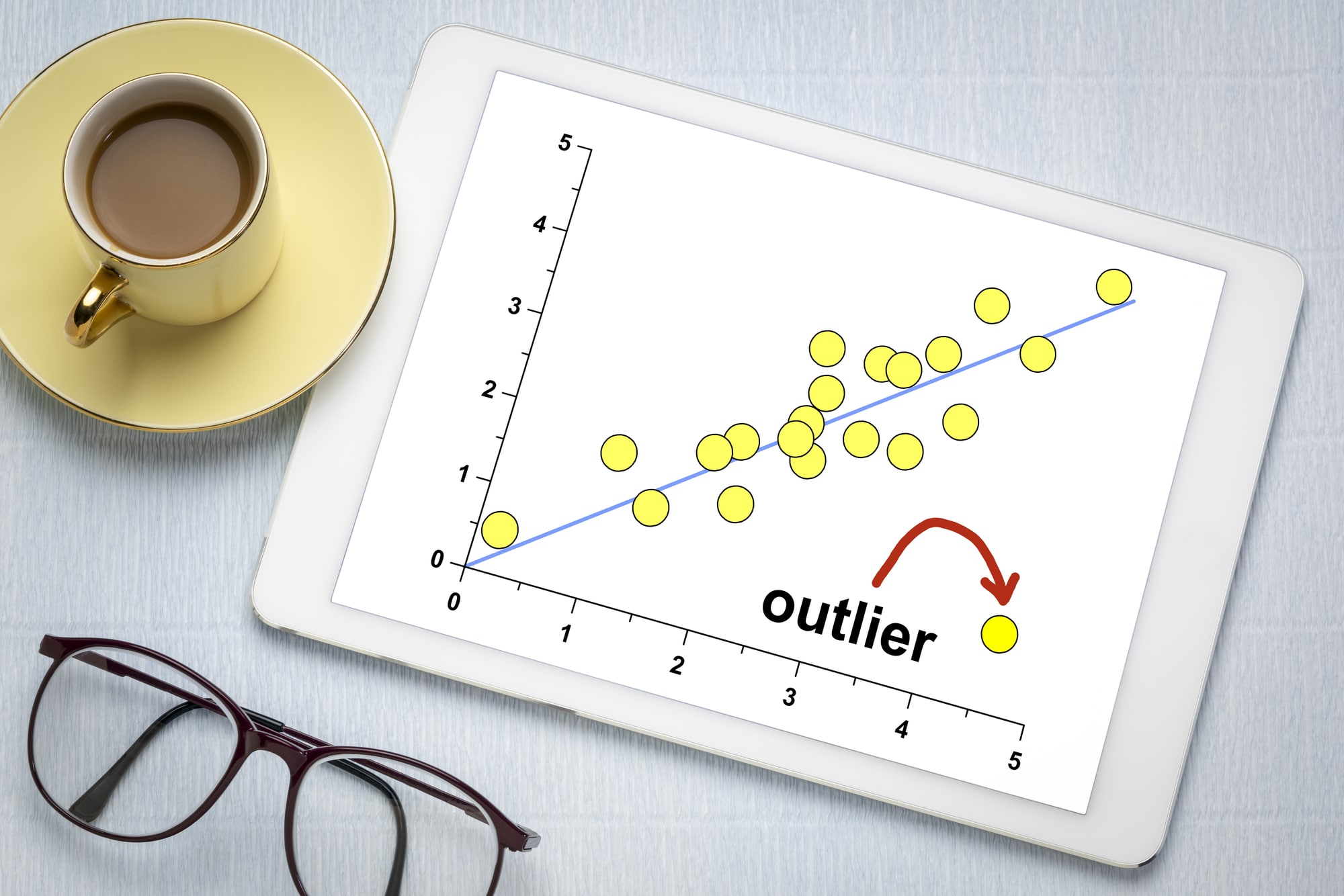

The trouble with outliers

February 13, 2024 | Posted by: Chad & Patty Southwell

An outlier is something that differs extremely from most other things. As a mortgage agent we have access to over 50 lenders, with a full spectrum of financing options. Lenders have gen ... [read more]

A case for raw land investment

February 8, 2024 | Posted by: Chad & Patty Southwell

Real estate investors traditionally have sought residential rental properties as a means to add assets to their portfolio. While this is a long term plan, it has served many well. Rent is ... [read more]

3 ways to shore up your mortgage

February 8, 2024 | Posted by: Chad & Patty Southwell

A volatile economy should be reason enough to explore ways to increase financial security. Your mortgage is likely the biggest debt and your home, the most important asset you have. With a ... [read more]

3 Solutions to overcome a low appraised value

January 31, 2024 | Posted by: Chad & Patty Southwell

Appraisals are a professional assessment of a property's worth. Mortgage lenders require appraisal reports as a final word to deem value. Reports can vary vastly depending on many factors, ... [read more]